A key finding of the SpendTrend 2024 report, a collaboration between Discovery Bank and Visa that analyses credit card spending behaviour to understand consumer spending habits.

The results of the research were presented recently at Discovery Place in Sandton by Discovery Bank and Discovery South Africa CEO, Hylton Kallner, and Lineshnee Moodley, country manager, Visa SA.

“South Africans are well known for their resilience across the world, and it is the same in their spending. As a result the country’s spending has not been characterised by wild swings, as in other countries, but by a consistency,” says Kallner.

The report highlights trends across three areas:

Personal consumer spending in South Africa steadied in 2023.

While South African consumers have shown resilience in an increasingly complex economic environment with interest hikes, 86%* of South Africans have expressed concerns about the increasing prices of everyday goods.

Spending in the High Net Worth (HNW), Everyday Affluent (EA) and Mass affluent (MA) segments is rising while spending in the Mass (M) segment has decreased slightly.

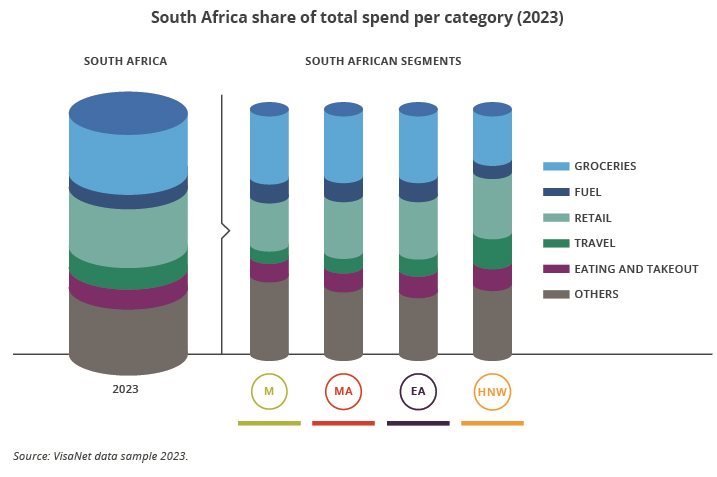

Groceries, retail, travel and fuel are the biggest spend categories for South Africans. While these four segments make up nearly two-thirds of the total spend, the breakdown by market segment varies. For M, MS and EA, groceries are the top category for spend, while for the HNW category retail is the main spend category.

The average grocery spend in South Africa rose by eight percent (compared to 2022). Grocery spend growth has ranged from zero percent in the M segment to eight percent in the HNW segment. This shows that the M segment has adjusted its purchasing to cope with rising costs.

Overall in 2023 consumers visited grocery stores and made online grocery purchases more frequently, however, the average amount spent per transaction remained about the same as in 2022.

Despite eating out and takeout increasing last year by eight percent (28% in 2022) almost three-quarters of South Africans* say they cook/bake at least once a week.

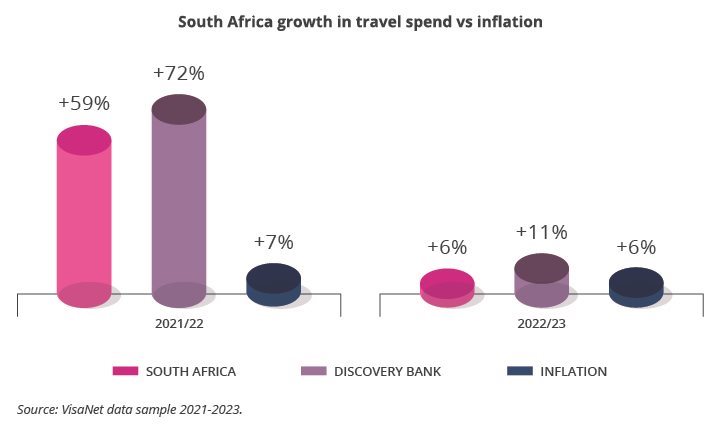

Travel is returning to normal but is costing more for everyone. The surge in revenge travel is over and South Africans' travel habits have settled. Overall travel spend has increased but only because of rising costs.

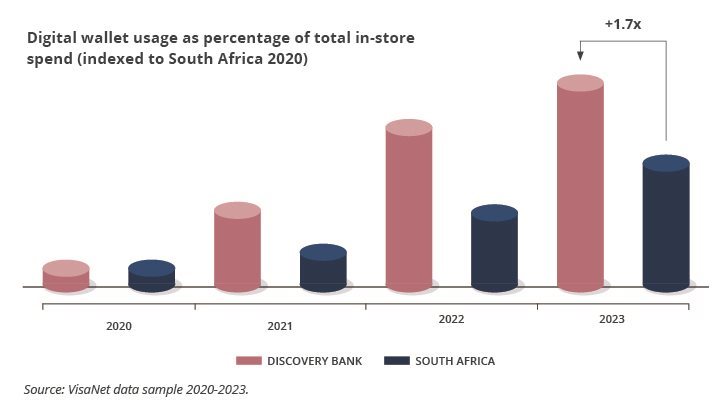

Digital wallet use has increased in South Africa by nine percent, with more than 60% of South Africans preferring digital wallets. South Africa’s growth in spending and frequency of using digital wallets for payments has outpaced all other global cities where digital wallet data is available.

“This shows that South Africans have a high level of confidence in using mobile wallets as a payment method. This growth is phenomenal and the financial services sector needs to understand the behaviour driving this if it is to grow,” says Moodley.

South Africans are embracing “phygital” shopping experiences. South African spend growth for online outpaces in-store by five times in 2023. This is surpassing other emerging markets and keeping pace with developed markets, with 84% of South Africans making an online purchase in the past year.

However, South Africans still value physical shopping experiences. South Africans still prefer shopping in-store, although they will compare prices online.

Online spend is also international with the rise in global online e-commerce platforms delivering to South Africa. Online entertainment is the fastest-growing online spend category for South Africans.

Online streaming services for music, series and movies are a key source of entertainment.

*of South Africans surveyed in 2023