The survey was conducted between 27 May and 6 June 2019 and comprised agribusinesses operating in all agricultural subsectors across South Africa.

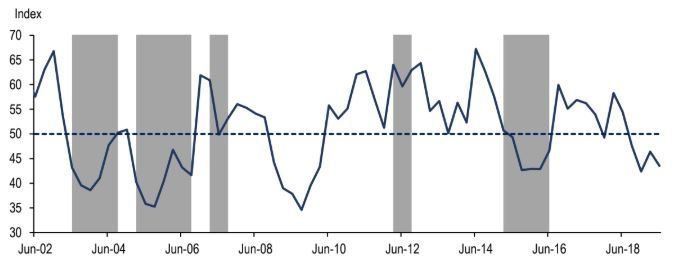

The overall Index comprises 10 subindices, most of which are still generally subdued compared to the long-term average levels, which is since its inception in 2001. Moreover, the deterioration in sentiment in the second quarter of this year was underpinned by seven out of the 10 subindices that make up the Composite Index.

Confidence regarding the turnover subindex dropped from 61 in the first quarter of the year to 58 points. The decline emanated from firms that operate in the summer grains and oilseeds sectors, wool and livestock sectors. There are two major factors that explain the slight deterioration in confidence in these subsectors.

Firstly, the delayed and expected poor summer grains and oilseeds harvest could weigh on the finances of agribusinesses that operate in the grain sector. Secondly, while South Africa has made strides in lifting the ban on wool exports to China, there are still some impediments related to Sanitary and Phytosanitary (SPS) measures that are yet to be resolved which constrained exports over the past couple of weeks.

After improving to 64 in the first quarter of this year, sentiment regarding the market share of agribusiness fell to 56 points in the second quarter, partly on the back of expected lower output this year, specifically in summer grains and oilseeds, and some horticultural products.

Not surprisingly, the employment confidence fell by 6 points to 48, which is the lowest level since the third quarter of 2015 – which was a drought year. The reduced activity in the fields on the back of unfavourable weather conditions might have contributed to this despondency. Also worth noting is that agricultural employment has generally been under pressure with the latest Quarterly Labour Force Survey data (Q1: 2019) showing that South Africa’s primary agricultural employment fell by 1% from the corresponding period last year to 837,000.

The capital investments confidence reversed the previous quarter's gains, falling by 2 points to 59 in the second quarter of this year. Fortunately, this is still above the neutral 50-point mark, which implies that the South African agribusiness environment is still a positive investment case. Be that as it may, the lack of clarity regarding land reform and water rights remains an overhang that could constrain the potential expansion in fixed investments.

Confidence regarding the export volumes deteriorated by 21 to 36 index points in the second quarter of 2019. This generally mirrors the expected reduction in agricultural output on the back of unfavourable weather conditions, and also reduced wool and other animal-based exports to China over the past couple of weeks.

The general agricultural conditions subindex fell by 1 point to 31 in the second quarter of 2019. This still mirrors the tail-end effects of the below-average rainfall in the central and western parts of South Africa during the summer crop season.

This subsequently led to a reduction in South Africa’s 2018/19 summer grains and oilseeds area planted, which were estimated at 3.7 million hectares, down by 3% year-on-year. This overshadowed the positive sentiment from the winter crops growing areas which have thus far received good rainfall, and expected to increase the area plantings.

On the upside, the perception regarding economic conditions improved by six points to 27. With that said, this is still well below the long-term average of 41 points. Moreover, the disappointing high-frequency data over the past few weeks suggest that South Africa's economic fortunes could remain constrained for the better part of this year.

The net operating income confidence improved marginally by one point from the first quarter to 48. The observations across the respondents suggest that the optimism was also driven by the horticultural sector as well as financial and agrochemical entities.

The debtor provision for bad debt and financing costs sub-indices are interpreted differently from the above-mentioned indices. A decline is viewed as a welcome development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the second quarter of this year, the sentiment regarding the debtor provision for bad debt lifted by three points to 35, partly underpinned by expected lower harvest in the grains, oilseeds and some horticulture subsectors.

Meanwhile, the financing costs sub-index fell by five-points to 33. This could partially be on the back of the expectations that the South African Reserve Bank could cut the repurchase rate sometime during the year.

While there are a number of factors that influence agribusinesses decision-makers, the erratic weather conditions which led to a reduction in summer crop plantings and the lack of clarity on land reform policy and water rights remain the key factors that underpinned the existing despondency in the sector. A persistent decline in confidence is typically followed by a similar movement in investment, but fortunately, this has not been the case in South African agriculture thus far.

One data point that we observe closely, although it is not a perfect indicator of measuring investment reaction to policy changes in the short term, is the Gross Fixed Capital Formation. This declined by 1% year-on-year to R17.1bn in 2018. The agricultural machinery market over the past few months has also seen some promising activity, albeit at lower than 2018 levels, which can be explained by a reduction in summer crop plantings.

Overall, while climate is largely outside the government’s control, the new Ramaphosa administration will need to move quickly to clear any lingering uncertainty about agricultural and land reform policy and biosecurity measures in order to unleash the full potential of this important sector, and contribute to boosting the rural economies.